We looked into 9 companies to help you find the right coverage

The best homeowners insurance providers have the perfect mix of financial strength, coverage options, and customer service. You’ll want to compare quotes between several providers and choose one that offers discounts and coverage for your particular circumstances. Our quote tool can help you compare rates and find the best fit for you.

How We Chose the Best Homeowners Insurance

Financial strength ratings

The best way to compare financial solvency among insurance companies is to use financial strength ratings (FSR) from independent agencies. With a higher financial rating, the company is more likely to satisfy large claims (like if your house burns down). Since the whole point of insurance is to protect you financially, it’s vital that your carrier has enough money to pay out its claims — which, in the event of a natural disaster, can be sudden and massive. We set the bar high — our picks needed to have at least an A rating from A.M. Best, the only agency that focuses solely on insurance. Then, because the Insurance Information Institute recommends getting ratings from two or more agencies, we also required a high FSR from at least one of the two largest agencies: at minimum, a “strong” (A) rating from Standard & Poor’s or “high quality” (Aa) from Moody’s.

Endorsements

Endorsements are optional provisions that can be added to a policy at the owner’s discretion. The more endorsements offered, the more you can fill in any gaps your policy specifically does not cover — the endorsement for earthquake coverage is a common addition in Los Angeles, for example.

Customer service

A good customer service rating for a homeowners insurance company (80+ from Consumer Reports or 3+ from J.D. Power) will mean painless communication in every phase. You’re more likely to receive accurate quotes and sufficient coverage and be properly compensated for claims. We looked to J.D. Power’s annual U.S. Household Insurance Study, which includes scores based on how well “customers rate the claims experience with their current homeowners insurance provider.” Consumer Reports also published data from nearly 10,000 survey respondents who filed claims from January 2010 to June of 2016, in which they rated carriers on criteria including agent courtesy and prompt problem-free claims experiences.

Discounts

To find the best price possible, your homeowners insurance company should offer plenty of chances to save. Often, the most significant discounts, like those for owning a fire extinguisher or being claim-free, are offered by every provider. However, there are a few exclusives worth noting: Allstate’s “new purchase” discount gives a small break to owners who are moving into their home for the first time (regardless of whether the home itself is new), and Travelers’ Green Home Discount knocks five percent off the premium price for homes certified “green” by the Leadership Energy and Environmental Design (LEED) organization. We tallied and compared the discounts offered by each provider, to help you find your best.

The 9 Best Homeowners Insurance Companies

- Allstate

Best for New Homebuyers - Amica

Best Customer Service - State Farm

Most Personalized Online Quote - Nationwide Insurance

Most Endorsements - MetLife

Best Replacement Coverage - Travelers

Best for Green Homes - Safeco

Unique Bundled Deductible - Progressive

Best for Boat Owners - GEICO

Strongest Financial Outlook

Our Top Picks for the Best Homeowners Insurance

Allstate: Best for New Homebuyers

| Pros | Cons |

|---|---|

| Abundant online tools | Average customer service |

| Extensive endorsements | |

| The most discounts |

Why we chose it

Abundant online tools

To help you better understand the industry, Allstate’s website contains a library of best-in-class resources — everything from articles and videos to quizzes and infographics. Particularly impressive is the Common and Costly Claims tool that lets shoppers type in their ZIP code to see the most common claims in their region, complete with average dollar amounts for those claims. There’s also a startlingly realistic GoodHome home report that plays a Google Street View video of your home (or potential home) as it enumerates potential risks and gives local hazard data, plus prevention tips. Tools like this make it simple to understand areas of your coverage for which you’ll want to increase your existing limits, or that you might need to supplement because the risk is higher in your particular neighborhood.

Extensive endorsements

Allstate has the second largest number of additional endorsement options. Those additional endorsements are fairly low-risk: insurance for expensive sports equipment, musical instruments, or your landscaping. Notably absent is additional coverage options for earthquakes and theft of other property (vehicles, trailer, watercraft). If either of those are personal concerns, check to see if they’re already included in your quoted policy or look for a provider that offers endorsements for them (like Nationwide or State Farm).

The most discounts

Allstate also offers the largest volume of discounts (11 total) of the companies on our list, including standard discounts like hosting smoke alarms, fire extinguishers, or deadbolt locks. It’s also the only company that offers discounts for signing up before your current policy expires and a discount for new customers during the first two years they’re insured.

Points to consider

Average customer service

Of our favorite insurers, Allstate earned the lowest customer service scores. From J.D. Power, it earned 3/5 and from Consumer Reports 80/100. These scores pale in comparison to providers like USAA and Amica, but are still miles ahead of other service industries like internet service providers. When we tested its customer service ourselves, Allstate answered all of our questions politely and allowed us to end the call without signing over our social security number. If stellar customer service is your first priority, you might want to choose Amica instead, but we think most people will still be satisfied with Allstate.

Amica: Best Customer Service

| Pros | Cons |

|---|---|

| Outstanding Customer Service | Lack of online resources |

| Considerable discount selection | |

| Dividend potential |

Why we chose it

Outstanding customer service

Amica consistently ranks among the top homeowners carriers for J.D. Power and Consumer Reports due to its sky-high customer satisfaction. In fact, Amica was the only one of our top providers that received a 5/5 in every category from J.D. Power. This is a particularly impressive feat when it comes to “claims factor” — a rating based on customer satisfaction with the settlement, estimation, and repair process — arguably the most essential element of good customer service in this industry. From Consumer Reports, Amica received a reader score of 94, two points better than USAA, the gold standard in insurance. With “excellent” scores in each category, you can expect timely and helpful interactions with Amica representatives and a relatively pain-free claims process.

Considerable discount selection

Amica offers nearly as many discounts as Allstate, with exclusive discounts for being a long-time customer and for opting into e-bill paperless pay. Essentially, by doing less (mailing bills and switching providers), you’ll save money with Amica. However, Amica comes up a little short on discounts for new and renovated homes — you’ll want to turn to Allstate for price breaks on those.

Money-back with dividends

As a mutual company, Amica is owned by policyholders rather than investors or stockholders. This means that as a policyholder who chooses this option, you could receive a dividend at the end of the term worth somewhere between 5 and 20 percent of your annual premium — depending on the financial success of Amica during that term and the company’s income after claims and expenses. However, these policies will have slightly higher premiums, and dividend payouts aren’t guaranteed.

Points to consider

Lack of online resources

When it comes to online resources and navigation, Amica’s tech feels quite dated. Its bare-bones site only details the basics of its policies and discounts. You won’t find anything like Allstate’s abundant and interactive resources, or guidance on how to build your policy. Thankfully, though, Amica scores so highly in customer service, we’re sure quick phone call can get you the information you need.

State Farm: Most Personalized Online Quote

| Pros | Cons |

|---|---|

| Detailed online quote process | Minimal discounts |

| Vast online resources |

Why we chose it

Detailed online quote process

As with all of our picks, you can get a quote from State Farm online. But State Farm’s process involves extra-detailed questions about the construction of your home, down to the percentage of carpet-covered floors and the number of corners in your home’s framing. We recommend arming yourself with floor plans, your insurance history, a home inventory, and specific details of your home’s construction so there won’t be any surprises when it’s time to sign a policy contract. The upside is that all of these details provide you with an accurate quote.

Vast online resources

State Farm writes more homeowners insurance policies than any other carrier in America, which speaks to its exceptional customer retention. Though not as comprehensive as Allstate’s offerings, State Farm’s tools, discounts, and resources are all top-notch. Its Simple Insights blog provides tips for everything from fire prevention and home security strategies to house shopping and landlord advice. Many topics even feature video tutorials.

Points to consider

Minimal discounts

State Farm offers standard discounts for installing certain protective devices in your home, such as smoke detectors and fire alarms. However, you won’t get any price breaks based on the age of your home, even if it’s newly built. Similarly, State Farm doesn’t provide discounts for new homeowners or for homeowners who have recently completed renovations, both of which are offered by Allstate, Safeco, and Amica. If you’re a newer homeowner or your house recently received a face-lift, it might pay to shop around elsewhere. One exception: If your roof was built using impact-resistant roofing products, State Farm does offer a unique discount for that particular renovation.

Nationwide: Most Endorsements

| Pros | Cons |

|---|---|

| Most endorsements | Expensive Policies |

| Brand-new belonging coverage |

Why we chose it

The most endorsements

Of our top picks, Nationwide offers the most options for additional coverage. These extra endorsements include standard additions like earthquake, flood, and umbrella liability, as well as more uncommon coverages like ordinance insurance that helps rebuild older homes to current building codes when damaged. In cases where your roof has been damaged, there’s a Better Roof Replacement option where you’ll be reimbursed for investing in material and construction that rebuild a stronger roof than you had before. To take advantage of this, however, the damage has to be severe enough to warrant an entire replacement, and your existing roof must be substandard.

Brand new belongings coverage

We also like Nationwide’s Brand New Belongings coverage, which will apply to nearly every homeowner. Essentially, it’s a rebranding of the standard extended replacement coverage. Rather than reimbursing you for the depreciated value your item had when it was lost/stolen, you get the funds to purchase that item brand new. However, with Nationwide’s program, you get funds up front (at their actual, lower value), and they’ll reimburse the difference it takes to buy the new item. It’s designed to immediately give you partial funds for replacing or repairing items, and then full reimbursement once receipts are received post-purchase.

Points to consider

Expensive policies

Nationwide ranks average in customer service but has a reputation for expensive policies. On the Better Business Bureau website, customer reviews mention that quotes from Nationwide tend to be more expensive than the competition. We always recommend shopping around for quotes, but if price is your main consideration you may want to skip Nationwide. For homeowners interested in full and specific coverage endorsements, it’s worth screening a policy.

MetLife: Best Replacement Coverage

| Pros | Cons |

|---|---|

| Unique replacement coverage | Poor website interface |

| Strong customer service |

Why we chose it

Unique replacement coverage

One of MetLife’s standard coverage offerings is exceedingly rare in today’s market: guaranteed replacement cost coverage for both structure and contents. This means that if your home and everything inside are completely destroyed, your MetLife policy guarantees the full cost of replacing them. Other providers typically only offer extended replacement cost coverage, which means the insurance company will only pay 25 to 50 percent more than the value of the home. For example, let’s say your home is valued at $250,000, but it costs $500,000 to replace. With guaranteed replacement coverage, MetLife will pay the full $500,000 cost to replace your home, while other providers might only pay up to $425,000. In a worst-case scenario, that extra coverage can make a real difference.

Strong customer service

When it comes to servicing customers, Metlife ranks impressively. Its Consumer Reports Reader Score was a solid 89, second only to Amica. Specifically, Metlife customers enjoyed its timely payouts and claims-filing experience. You can expect simple and prompt handling of your claims during the most tragic times with Metlife.

Points to consider

Poor website interface

If you prefer to shop online, Metlife isn’t for you. Its website pales in comparison to our other providers’ sites, with nothing more than a landing page and a mini FAQ that answers just seven standard questions. And if you’d like to compare quotes online, you’ll have to live in one of the 10 states that offer digital policies.

Travelers: Best for Green Homes

| Pros | Cons |

|---|---|

| Green home discount | Poor claims handling |

| Impressive financial strength |

Why we chose it

Green home discount

If you’re dedicated to living a little lighter on the environment, and have made improvements to your home to reflect that, you may be up for some serious price cuts with a Travelers policy. You can save five percent if your home is certified “green” by the Leadership Energy and Environmental Design (LEED) organization. LEED-certified homes will have sustainable construction and utility systems, plus community resources (transit access, trails) that all echo an environmentally-conscious lifestyle.

Impressive financial strength rating

Just after GEICO, Travelers earned the second-highest scores for financial strength. From A.M. Best, who specializes in homeowners insurance, Travelers earned the highest possible score, an A++. You can rest assured that your policies will be backed with Travelers, especially when disaster strikes.

Points to consider

Poor claims handling

Travelers scored pretty average with customers, earning a 3/5 from J.D. Power and an 82/100 from Consumer Reports. Complaints trend towards negative experiences with claims representatives, a lack of investigation, and a poor ability to determine liability. If you foresee some tricky or frequent claims with things like unforeseen damage or piping issues, we’d suggest another insurer.

Safeco: Unique Bundled Deductible

| Pros | Cons |

|---|---|

| Exclusive bundled deductible | Few discounts |

| Equipment breakdown coverage |

Why we chose it

Exclusive bundled deductible

Safeco stands out for its two unique coverage options. If you insure your home and car through Safeco, you’re eligible for the “single loss deductible,” which allows you to pay only one deductible in the event of multiple losses. For example, if both your home and car are damaged in the same accident, you’re only required to pay the home deductible. Safeco is our only pick that offers this, and it could make a big difference in how much you have to pay in the event of a serious disaster.

Equipment breakdown coverage

Safeco also offers equipment breakdown coverage. If an appliance breaks beyond repair, Safeco will pay to have it replaced with an Energy Star-rated appliance of a similar quality, saving you from having to replace appliances out of pocket or purchase a separate home warranty.

Points to consider

Few discounts

Safeco offers the fewest discounts (just four in total) in comparison to our other picks: just a few standards like multi-policy and a new home discount, with a single standout discount if you opt to pay your yearly bill in full (rather than monthly). If your personal profile qualifies for discounts offered by other companies (i.e. your home is security outfitted), there are options more savvy than Safeco. But if you already have insurance with Safeco, its bundled savings could be significant.

Progressive: Best for Boat Owners

| Pros | Cons |

|---|---|

| Impressive customer service | Extended endorsements |

| Varied underwriters |

Why we chose it

Impressive customer service

In J.D. Power’s most recent study, Progressive ranked alongside State Farm and Allstate. Customers claim that Progressive offers reasonable prices and attentive representatives. We especially liked its online quote tool. After you’ve filled in all your information and home design details, you’ll get an online price. Progressive uses other companies to underwrite its homeowners policies, and typically companies automatically pair you with an underwriter. With Progressive, it’ll give you quotes for several of its underwriting partners and you can choose which suits you best. This gives you the power to prioritize coverage and price.

Extended endorsements

Progressive offers a unique Inflation Guard endorsement that will dynamically adjust coverage amounts to keep up with inflation, so the money you’ll need for repairs will be sufficient even as the market’s construction costs rise. Its coverage extends to cover things like pools, sheds, and fences at no additional cost. Progressive also offers a watercraft endorsement that allows you to extend your personal liability and medical coverage to small sailboats and motor boats.

Points to consider

Varied underwriters

Progressive’s service varies heavily by state. As the company explains it, “Insurance through the Progressive Home Advantage® program is underwritten by select companies that are not affiliates of Progressive and are solely responsible for claims, including Homesite Group Incorporated, IDS Property Casualty Co., and ASI Lloyds, and their affiliates.” Basically, Progressive isn’t selling its own homeowners insurance directly, but has partnered with a company (the one that will pay your claim), in order to offer that insurance to its customers. If you’re already a Progressive customer, no need to stray. If you’re considering opening a policy with Progressive, though, be aware your options for discounts and coverage will vary by state.

GEICO: Strongest Financial Outlook

| Pros | Cons |

|---|---|

| Strong financial outlook | Doesn’t underwrite policies |

| Auto insurance bundling | Mediocre customer service |

Why we chose it

Strong financial outlook

While all of our top picks have excellent or superior financial outlook, Geico received the highest possible financial strength ratings from both A.M. Best (A++) and S&P (AA+), plus one of the best from Moody’s (Aa1) — a good indication that the company will be able to pay out any claims. Financial ratings like these are extra assurance that your insurer can still prioritize your policy if it gets hit with a lot of claims simultaneously.

Auto insurance bundling

Geico and its little green gecko are known for auto insurance, and it was our top pick for the best auto insurance. With high claims satisfaction scores and span of discounts, it’s a great auto insurer. You can access your policy using Alexa or its mobile app and integrate your Facebook profile. If you’re shopping for auto insurance, Geico is a good bet, and bundling it with your homeowners insurance will increase your savings and streamline your services.

Points to consider

It doesn’t underwrite its own policies

Like Progressive, Geico uses partner affiliates for homeowners insurance, rather than underwriting directly. So when getting a quote through Geico, the company will automatically pair you with one of its partners at some point during the online quote process. When it’s time to make a claim, Geico will direct you to the contact information for the company that sponsors your policy. Basically, Geico is a middleman that exists almost exclusively to provide insurance for customers who already have an auto insurance policy (which the company underwrites itself).

Mediocre customer service

On the other hand, Geico was the most difficult when we called companies to shop around. Representatives refused to answer any of our questions without our detailed personal information and financial details. In other words, unless you’re ready to purchase from them, don’t expect a particularly helpful phone call.

Guide to Homeowners Insurance

How to choose your homeowners insurance company

Calculate your home’s reconstruction cost

In the event of a disaster, it’s vital that you obtain the right amount of coverage — that’s what’s going to pay for your repairs and/or a full rebuild. Your coverage limits for personal belongings and other structures are related to the amount of coverage on your dwelling, so you’ll have better protection for all your property if you lift your dwelling limit. “If you have a mortgage, your lender may only require you to purchase a policy with enough coverage to protect their interest — particularly if you have a low balance,” says Christina Moore, a compliance and risk management VP at SWBC. “But in the event of a substantial or total loss, the cost of rebuilding your property could be much more, leaving you with potentially large out-of-pocket expenses.”

Catalog your belongings

“I recommend that people create video evidence of all their belongings, as well as the inside and outside of their home,” says Jeffrey D. Diamond, adjunct professor of insurance law at Georgia State University College of Law. Many providers have online lists you can help to keep track. “The more ways in which you can establish and prove the features of your home, as well as the quality and quantity of your personal property before a loss occurs,” Diamond adds, “the better your homeowners insurance coverage will serve you at the time of need, if and when the need arises.”

Consider your location.

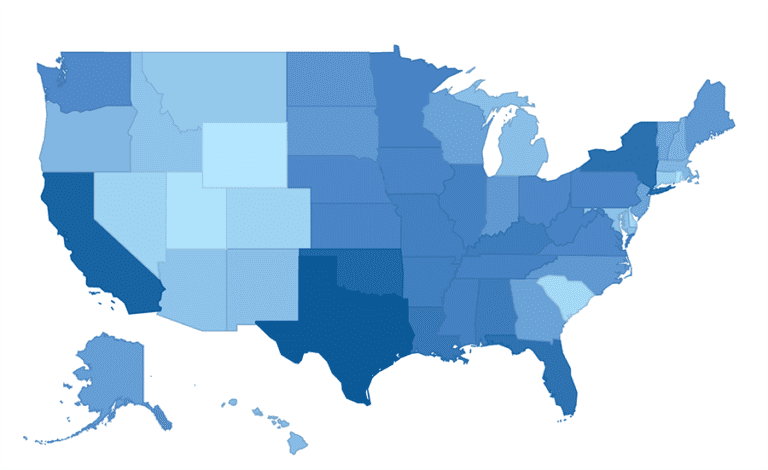

We built a map displaying the historical frequency of floods and severe storms based on data from the Federal Emergency Management Agency (FEMA) and the National Emergency Management Association (NEMA). If you live in one of the darker blue areas, look for the specific endorsements that apply to your region and which providers offer them. Texas, for example, has the highest count of natural disasters. If you live in a region often affected by floods and storms, you’ll want to look for a company that offers additional flood coverage or purchase it separately through the National Flood Insurance Program.

Get a few quotes by phone.

“Calling around to obtain quotes will take some time, but it is worth it to compare coverage and rates,” says Moore. Unlike auto insurance quotes, homeowners insurance quotes are more accurate when you call. The online tools are attractive because they make it appear easy to compare quotes from multiple carriers at once, but they often oversimplify in their information collection. For instance, you might be eligible for a discount from a certain carrier that wasn’t detailed online, or you might want a specific endorsement it didn’t ask about. Call, go through each carrier’s specific questions, and then you’ll receive quotes that are worth comparing.

Homeowners Insurance FAQs

How much is homeowners insurance?

Coverage varies greatly among regions, homes, and asset portfolios. If you and your neighbor called all the same providers asking for quotes, there’s a good chance the lowest option for you would come from a different provider than the lowest option for them. There’s no universally cheaper carrier. For some context, premiums can range in price anywhere from $500 to $2,000.

What is covered by homeowners insurance?

Simply put, there are six main categories that homeowners insurance covers: your dwelling, other structures, personal property, loss of use, liability, and medical payments. Within each category are particular coverages and exclusions. For example, water damage is covered under “dwelling” as a result of burst pipes or water heater but not as a result of heavy rainfall or flooding (though coverage for the latter can be added separately). And while water damage from the burst pipe is covered, your policy won’t cover the cost of replacing those pipes.

Standard coverages by homeowners insurance:

- Dwelling (also called Coverage A). This includes the main building and its plumbing, heating, and air conditioning systems against damage from outside forces.

- Other structures (or Coverage B). This pays for damage to fences, sheds, garages, guest cottages, and any other structure not connected to your house.

- Personal property (or Coverage C). This reimburses you for lost, stolen, or ruined possessions such as furniture, electronics, and clothing, even when they aren’t on your property. You can choose to insure them for their actual cash value (the original value, less depreciation) or their replacement value (what it costs to buy a replacement in similar condition).

- Loss of use (or Coverage D). This pays for your living expenses during the time you’re unable to live in your damaged home.

- Liability (or Coverage E). This covers your financial loss if you or anyone in your family is sued for damages or injuries to someone else. The event doesn’t have to happen on your property. Increased limits for liability coverage — important if you own valuable assets that could be targeted in a lawsuit — can be added on as “umbrella coverage.”

- Medical payments to others (or Coverage F). This is intended to pay for relatively minor medical bills resulting from an injury, like if a friend cuts their finger while helping you make dinner.

As a general rule, any damage from natural or national disasters like earthquakes or war will not be covered. Added to that list is fungi, contamination, wear and tear, and pests

Will my premiums go up after making a claim?

In short, yes. Think carefully before filing a claim on your homeowners insurance, as it will directly affect the amount you’ll pay going forward. That increase can be as high as 20 percent, as you’re shifted into a “high risk” category if you have two claims within three years, or three claims within five years. And it could be another five years before those claims drop off your record and the premium prices decrease.

What’s the difference between homeowners insurance and a home warranty?

Homeowners insurance is there to protect you from financial ruin in the event of a disaster, not to cover normal wear and tear. A home warranty, on the other hand, covers the mechanical breakdown of systems in the home, like plumbing and electricity. If that sounds like something you want, check out our review of the best home warranty.

The Best Homeowners Insurance: Summed up

The Best Homeowners Insurance by State

Every state has different insurance providers, as well as unique circumstances that affect policies and coverage. We’ve reviewed the five largest providers in every state using a methodology similar to the one for this review on nationwide providers.